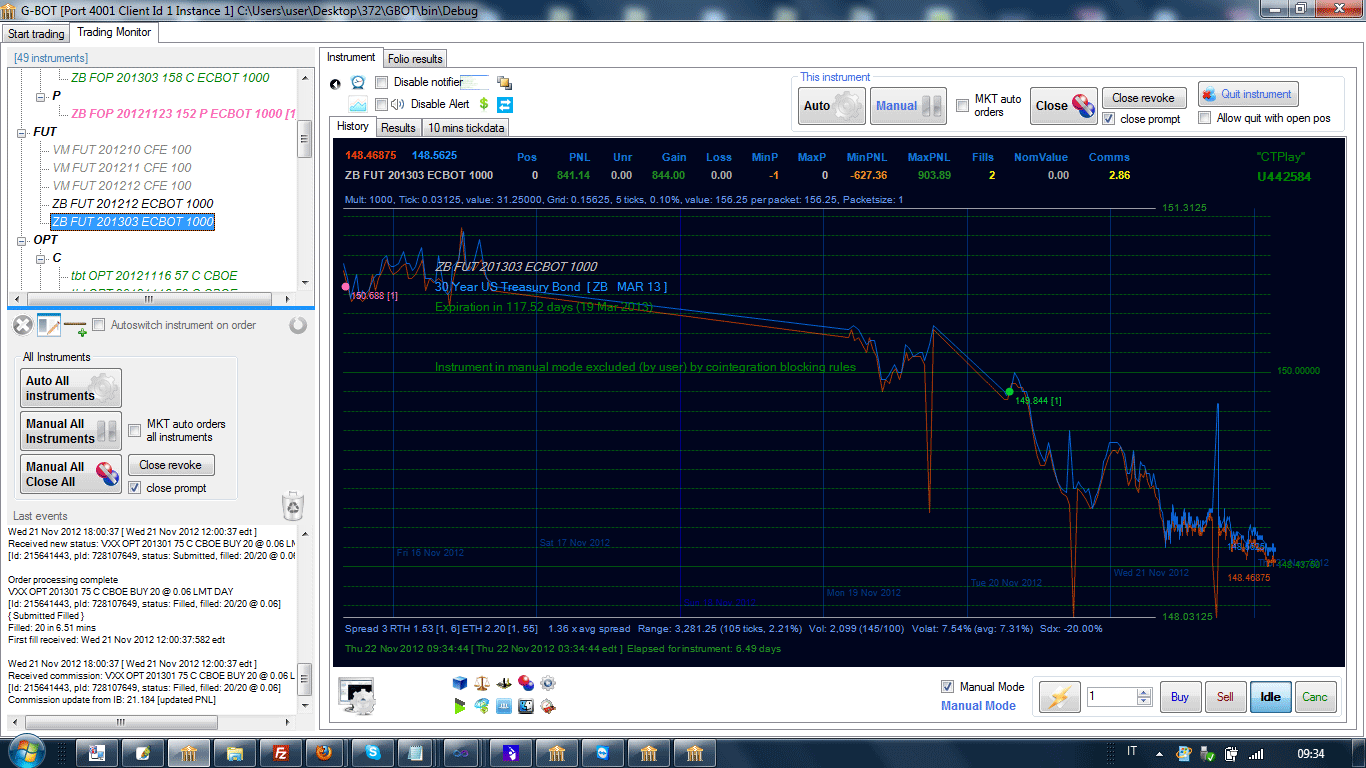

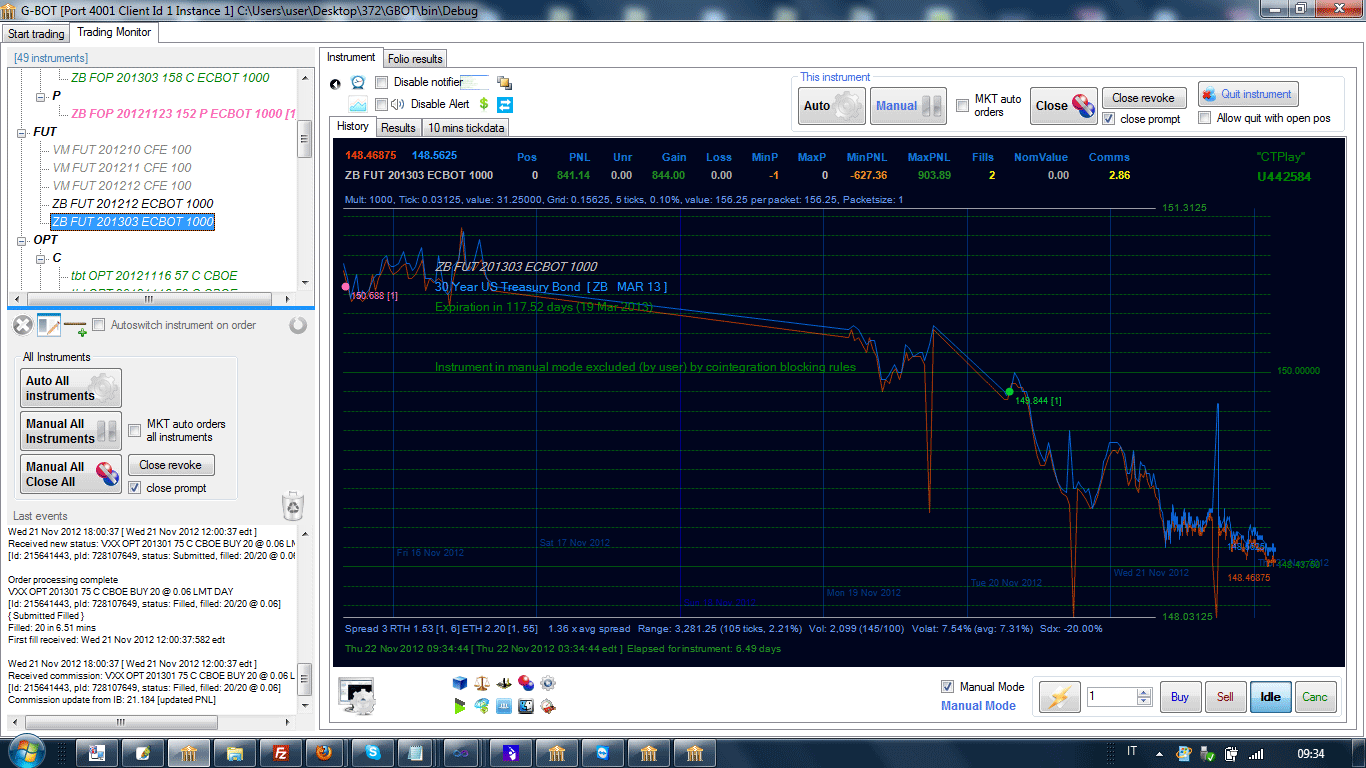

(Picture taken from G-Bot Algorithmic Platform)

Metrics for Algorithmic Trading:

(Tom Gastaldi's)

Direction and Codirection indices [draft version,

please report errors or

suggestions, thanks]

In finance there are several metrics which can be applied to algorithmic trading

as well.

However, a trader may find more useful and intuitive, other, more specific,

dynamic metrics, specifically designed for the context of

automated trading systems and algorithmic trading.

The SDX (Signed Direction Index), SCX (Signed Codirection index) and the other metrics described below have been proposed by Prof. Tom Gastaldi (and also implemented within G-Bot).

Summary of metrics on this page

- $peed

- Sideways %

-

SDX - Signed Direction Index

-

SCX - Signed

Codirection Index

(or "Signed Cointegration Index")

[see

also discussion

linked below]

-

Relative exposure of correlated instruments

Preliminary notes

Algorithmical reference system

The concept of "timeframe" is replaced by a reference system formed by grid lines. This is because an algorithmic trading system, to the purpose of decision taking, focuses mainly on price changes.

Imagine the price range subdivided in intervals

of a given width (based on

a prespecified percentage, for instance 0.1%).

Let's call the

lines marking the intervals, "grid lines" (or "price grid lines"). The distance between 2 given adjacent price grid lines

is called Gridsize and corresponds to a given

price percentage.

The grid line reference system

can be the basis of an algorithmical trading system.

Changing the grid value means expanding or shrinking the

granularity of our computations and might reflect focus on different

"timeframes", except that here our "clock" is defined solely

based on price moves. For instance, the scalps could be defined in terms of

a factor of the gridsize.

Example (a grid of 0.1%):

(Picture taken from

G-Bot

Algorithmic Platform)

Now we can define some metrics.

$ Speed (of the price) of an instrument

Alternate names: "$peed",

potential exposure

For an algorithmic trader, the concept of volatility (standard deviation of log returns) is somehow useful. However, a more specific concept can be defined, which is even more easily interpretable in an algorithmic trading context, and also can help better managing risk. The concept of "speed" also allows to introduce a "directional" component, which is not present in the volatility concept (volatility is simply the the standard deviation of the log returns).

Definition and algorithm

As the price moves, the grid lines will be "hit" by the price. We consider a dynamic list of "last" hits, where a "hit" is defined as the pair:

Hit = (T, P)

where: T is the instant of the event, and P is the price of the grid line being hit.

A new hit is inserted at the end of the list of hits only if it has a price different from the previous hit. When the length of the list reaches a prespecified size s, the length of the hit list is kept fixed, by removing the oldest entries.

Let's denote the Hit list as:

Hit(0) , .... , Hit(s-1)

Within this list, we consider k (k <=

s) terms equispaced (thus possibly resampling the

list to size k):

Hit(0) , .... , Hit(k-1)

We define (k-1) price changes, and (k-1) elapsed time intervals, defined as follows:

ΔP(i) = P(i) - P(i-1) i = 1, ... , k-1

ΔT(i) = T(i) - T(i-1) i = 1, ... , k-1

the $peed is defined as follows ("absolute" version):

Σ | ΔP(i) |

$peed = ----------------- *

ContractMultiplier * UserPacketSize

Σ ΔT(i)

where

UserPacketSize denotes the reference order size used by the trader (say the

tipical order size he intends to use as reference size for exposure evaluation.

The

UserPacketSize can also be a dynamic quantity: for

instance recalibrated realtime by the trading algorithm).

It is also possible, and

indeed more useful, to consider a variant which would not depend on the packet

size of each instrument in the folio. This could be called "intrinsic $peed" and

in a similar way as, but replacing UserPacketSize with a

constant, fixed for all instrumens of a given type (for instance, 100 for STK,

CFD, 1 for FUT, FOP, OPT, 10K for CASH).

This would allow for instance to correctly use a correlated instrument to hedge another instrument. In fact, for precise hedging, we need to take into account both the

notional amount invested, but also the "$peeds" at which the two different

instruments move.

It also makes sense to consider a "signed" version, where the

ΔP(i) are considered with their respective signs.

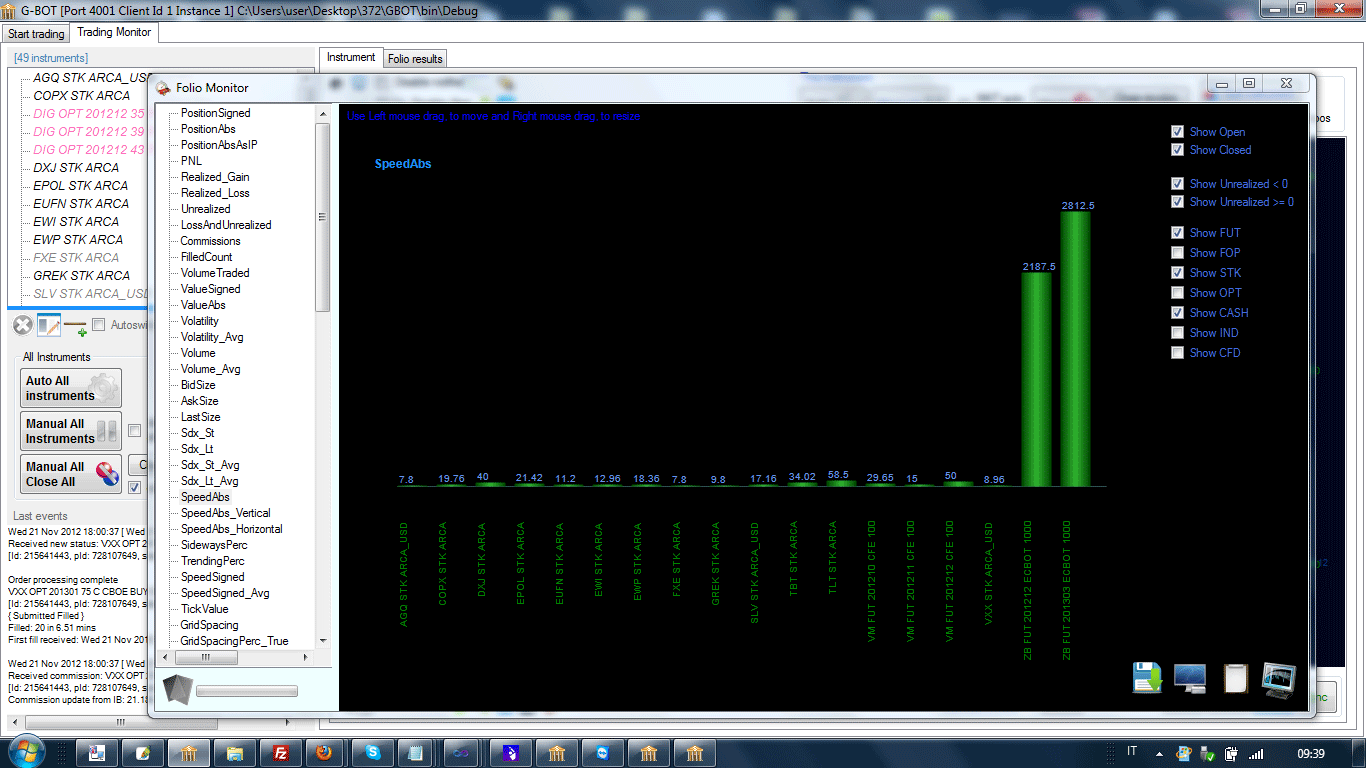

Example:

($peeds of various instruments (futures): picture taken from

G-Bot

Algorithmic Platform: this picture

denotes a badly unbalanced folio, where 2 instruments are towering over the

folio)

Sideways percentage of speed, horizontal component of

speed

When an instrument moves at a certain speed, its "trajectory" can develop mostly

sideways, or it can be "trending" up or down. This percentage index expresses how

much of the total speed of the instrument is expressed sideways. Clearly, the

complement to 100 is the percentage of the speed expressed directionally.

Definition and algorithm

We decompose the total speed into 2 components: a sideways component and a directional component. Alternatively, we can say, an "horizontal" component and "vertical" component.

Speed = Sydeways Speed + Vertical Speed

where:

Vertical Speed = V * Speed

Sideways Speed = S * Speed

with S + V = 1

The vertical-component coefficient V is defined as:

|

Σ ( for ΔP(i) > 0) | ΔP(i) | - Σ ( for ΔP(i) < 0)

| ΔP(i) | |

V = ----------------------------------------------------------------

Σ | ΔP(i) |

Given the vertical speed, we can obtain the horizontal speed by difference: Horizontal Speed = Speed - Vertical Speed

Finally, the Trending and Sideways percentages are defined as:

Vertical Speed

Trending % = ----------------------- *

100 = V * 100

Speed

Horizontal Speed

Sideways % = ----------------------- *

100

= ( 1 - V ) * 100 = S * 100

Speed

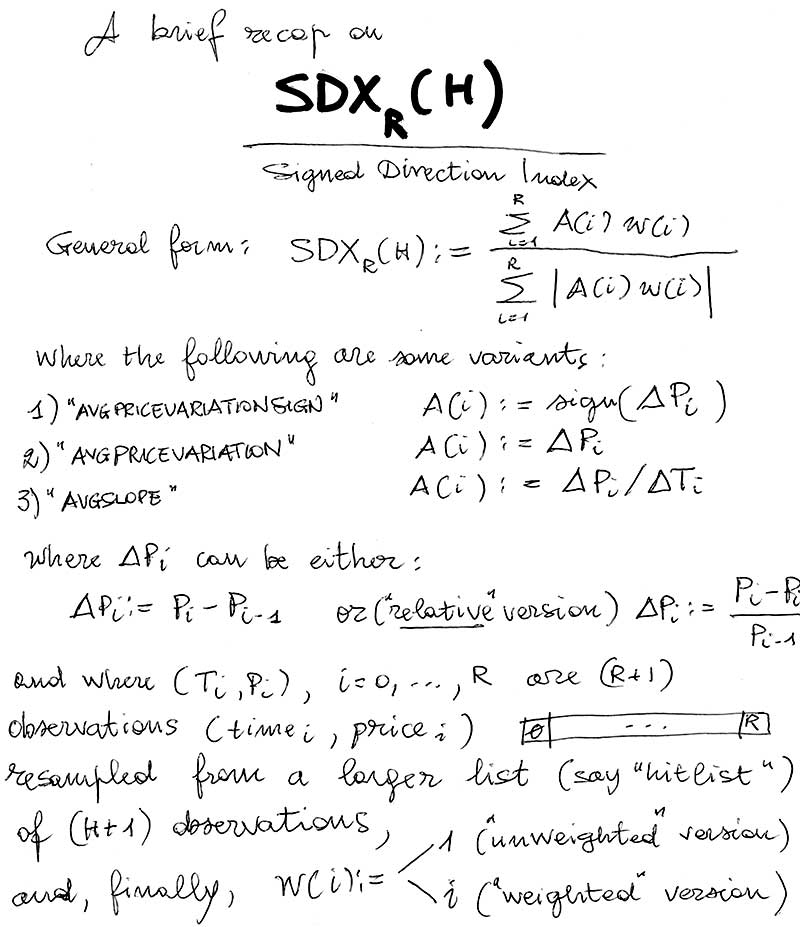

SDX - Signed Direction Index (of the price) of an instrument

The V coefficient of the directional component, taken with sign (and multiplied by 100) provides a "local" assessment of direction and "momentum" of the price of an instrument:

Σ (for ΔP(i) > 0) | ΔP(i) | - Σ (for ΔP(i) < 0)

| ΔP(i) |

SDX = =

------------------------------------------------------------- * 100

Σ | ΔP(i) |

it ranges between -100 (downward move) and 100 (upward move). Values (positive or negative) near 0, indicate a condition of "sideways" market.

It should be noted that the above sums do not run over all hits, but they must be

taken on a subsample of equispaced points within the hit list. The number of

intervals considered are a parameter of the SDX (and it's advisable they be an

even number, to allow SDX to be equal to 0). Thus, the SDX would be computed by

taking a given number of points equispaced within the hit list.

I usually use the notation SDXR(H), where R denotes the number of differences in

the resampled list, and H the same in the original list.

One can compute a Short term SDX and

a Long term SDX, depending on the

"priceframe" or hit list length

H considered. This is also used by G-Bot for some "entry styles" [good choices of hit list lengths for SDX_Lt and

SDX_St, are, for instance H=21

for a 100% volatility and scaled according to volatility (but never

less then the resampling size, obviously), while for the long

term, we multiply for a given factor (for instance 4, 5) and H=100, while, for

instance, R=5].

Note that SDX definition can stand alone and does not depend on

defining the $peed. Actually $peed could take alternate definitions (like

variants defined by the user) without affecting the definition of the SDX.

Also note that in actual implementation, we need not to refer to actual "hits"

of gridlines, but it is sufficient that the price moves away from the last

recorded price of a prespecified amount (for instance, the 0.1%)

Another variant, which I prefer, can be obtained by considering also the time

necessary for each price variation, as follows:

Σ ( P(i) - P(i-1) ) / ( T(i) - T(i-1) )

Σ ΔP(i) / ΔT(i)

SDXR(H) =

---------------------------------------- * 100 =

------------------- * 100

Σ | P(i) - P(i-1) |

/ ( T(i) - T(i-1) ) Σ | ΔP(i) |

/ ΔT(i)

which can be intuitively interpreted as a normalized average of "slopes".

Weighted version

A weighted version can also be considered, by assigning different (positive) weights w(i) to the consecutive price changes ΔP(i)

Σ

w(i) ΔP(i) / ΔT(i)

SDXR(H) = --------------------------- *

100

Σ |

w(i) ΔP(i) |

/ ΔT(i)

Note. It is important to remark that, in our approach (reflected in the G-BOT project), we do not make any "predictive" use of the SDX. The SDX is instead used merely to provide "check points" for internal "coherence" of the player cloud, and make sure that the preserved past trading information is used in the best possible way, to the purpose of hedging, and eventually have the algo "converge" to a permanent sell / buy avg "crossover".

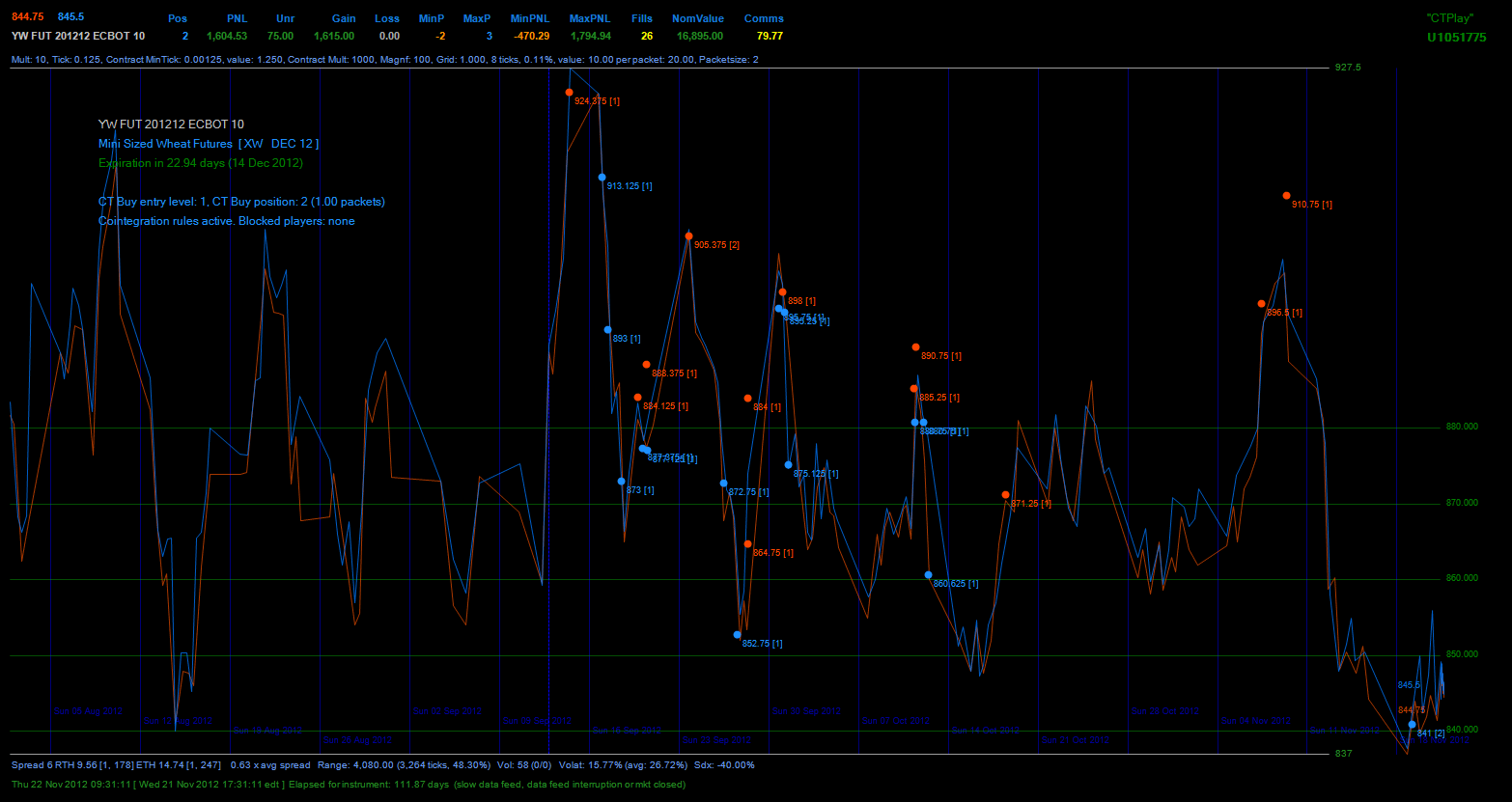

Example

This is an example of scalping carried out by using the SDX. This is a picture

of actual trading with real money, sent to me by a fund manager, along with the

following message:

"Here is a great example of G-bot at work. Simply put it

has traded like a maestro. There are many other examples of similar trading

patterns on other instruments.

Tom are you sure you don’t have sight of the future ?

J." [ Wed, Nov 21,

2012 at 11:33 PM ]

Relationships between the above concepts

From the definitions, one may notice that :

Trending % = | SDX |

Sideways % = 100 - | SDX |

As it is intuitive, the trending percentage is given by the absolute value of the signed direction index.

It is also possible to create metrics based on the "divergence" of 2 SDXs (one "short-term" and one "longer-term").

One fundamental (and rather persistent and often structural) aspect in the market, which is immediately evident when trading large folios, is the fact that some instruments "track each other" ("positively" or "negatively"). This can result in price curves which "look" essentially the same (example DIG and ERX) or that are essentially "specular" (e.g., DIG and DUG).

Sometimes we hear talking about positive or negative "correlation"

or "cointegration" between

instruments.

In statistics, the "correlation coefficient" is a measure of

"linear" correlation.

Here I introduce a simple index to measure the tendency of two price curves to

look like the same (index = 1) or to be a mirror image of each other (index = -1).

Denote these 2 lists (the recording times are the same for the two lists) as:

P1(0), P1(1), ... , P1(k-1), (for Instrument 1)

P2(0), P2(1), ... , P2(k-1), (for Instrument 2)

A simple, but effective, cointegration index, ranging in the interval [-1, 1] can be obtained (on a resampled set of points) as:

Σ

( sgn (

ΔP1(i) ) * sgn (

ΔP2(i) ) )

SCX =

-----------------------------------

N

where sgn() is the sign operator, N is number of the products considered in the above sum (possibly k-1), and the sum is taken over the nonnull products (factors

equal to zero, that in practice

would be rare and irrelevant, could be possibly: considered, skipped, or the result of product

defined according to a convenient convention).

Note that, just as for the computation of SDX, we operate on a

resampled set. (For instance, one might take a maximum of 100 differences). This is important to keep the

computation consistent, whatever is the number of prices collected for the computations,

and would allow to make possible comparisons.

This index will range between -1 and 1. A value of 1 means perfect

"codirection" (they "track each other"); -1 is also a perfect (negative)

codirection. Values near 0 will indicate situations where the 2 instruments

are, say, in no

codirection relation:

-1 ("specular" shapes) -------- 0 (no cointegration) --------- 1 (similar

shapes)

Another useful version, which also takes into account the size of price

variations and time intervals, is the following:

Σ

(

ΔP1(i) /T(i) *

ΔP2(i)/T(i) )

SCX =

-----------------------------------

Σ |

ΔP1(i)/T(i) *

ΔP2(i)/T(i) |

where T(i) denotes the time interval between two consecutive prices (intuitively, a mixed moment of slopes).

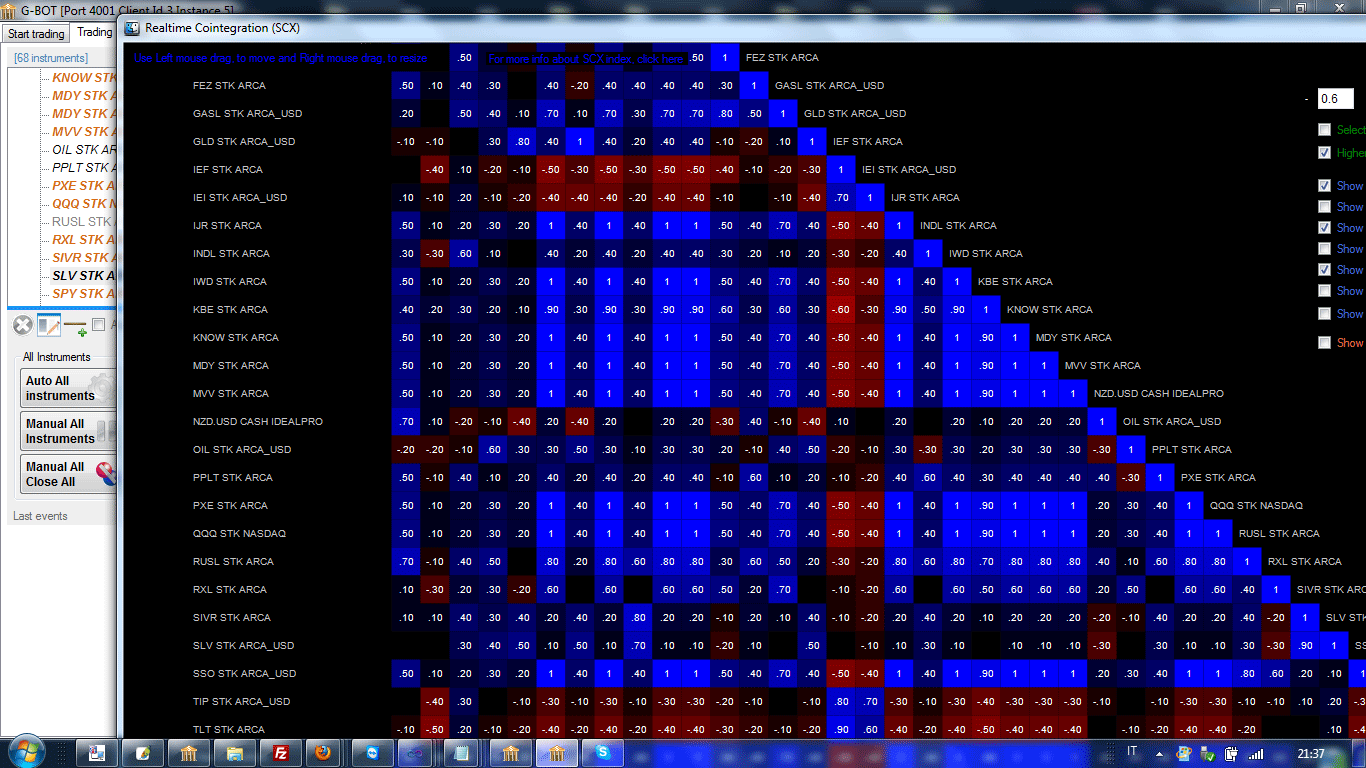

In practice, (independent) random instruments will

have small | SCX |. Absolute values depend on the resampling size steps one

uses. For instance with 100 steps, values less than 0.3 are in the realm of no

strong codirection yet. Larger absolute values (0.6 to 1) denote good "codirection". Around and beyond 0.9 we

have a practical coincidence of price curves (or perfect specular shape, in case

of negative correlation).

This index will not limit itself to capture a linear component of the

relationship (as it happens for classical cointegration indices), but it is

sensitive to any form of relationship. This is particularly appropriate

as the concept of linearity is just an elementary mental abstraction that finds no place in

the real market.

This is also the reason why we might prefer to

call it a "codirection index" in order to signify its broader scope.

See also this public discussion on Linkedin for more insight:

Example. SCX for various pairs of instruments (SCX matrix)

For this index too, one might consider an obvious "weighted" version.

Another possible application of this index, in addition to hedging functionalities, is within

arbitrage algorithms which would exploit the relative

"disalignment" of the involved instruments.

(Clearly, in such a case, we will also need to appropriately determine the

relative direction of each instrument w.r.t. the other one, which is pretty

straightforward to do.)

The main application is, however, in folio trading, where the SCX can be

effectively used to turn dependences into a powerful hedging tool. In fact,

exposure of some instruments can obviously be appropriately hedged by the exposure of other strongly

cointegrated (large absolute value of SCX ) instruments.

Exposure of a correlated set of

instrument, relative to an instrument in a folio

Define for each instrument , say I, in a folio of instruments the

following quantities:

SAE := "Signed (Volatility-Adjusted) Exposure"

REC := "Relative Exposure of Correlated Instruments"

Such quantities are defined as follows:

SAE := Closing Price * Position with sign * Multiplier * Volatility * 0.001 (so with $K as unit

of measure)

for instance, an instrument could have an exposure of 15.56K, and so on.

While, the "Relative Exposure of Correlated Instruments" is defined as follows:

Where corr(I,J) indicates your preferred correlation (or "codirection") metrics, such as for instance the SCX

This quantity, along with the instrument exposure SEA(I) is useful to rebalance exposure across layers, for instance, according to the following scheme:

The meaning of the schema seems intuitive. Let's consider, for

instance, SAE(I) > 0 and REC(I) > 0. In this case, both the instrument I and the

set of correlated instruments C(I) have a positive exposure. So a SELL order of

I would have an "hedging" effect on the exposure. Let's consider for instance

SAE(I) < 0 and REC(I) > 0. In this case, I is negatively exposed (it has a short

position), while the correlated instruments are "contrasting" this exposure

(either through opposite position under positive correlation or same side

position under negative correlation). Now, depending on which of the 2 exposure

is larger (REC(I) or SAE(I)), we have an exposure reduction either by Selling of

Buying (respectively) I. The other 2 cases are analogous.

Similarly, they offer an indication of the "role" of I within the folio. For

instance, if SAE(I) > 0 and REC(I) < 0 and |SAE(I)| < |REC(I)| we can interpret

the instrument I as having an "hedging value" within the folio and that it's

suitable for (signed) position increase. The interpretations of the other cases,

can be done applying a similar logic.